Updated October 21, 2022

Tellor as a protocol has been alive for three years now and has seen tremendous changes over the years. We continue to grow as a network, community, and project, continually using the lessons learned to create a better system that stays true to the values which we were founded on.

current state

As we make changes, we need to look at where Tellor is currently and where we can do better. Overall, when comparing Tellor to a year ago, we’re in a familiar spot. The price is down after a crazy volatile year, and although we have more users and are on more chains, it feels like the product market fit is still more elusive than we’d prefer. Granted we’re far from alone in the space in seeing users as the bottleneck, but as we propose tweaks to the protocol, we need to keep this main challenge in mind.

To us at Tellor, we have three priorities when it comes to making changes:

- How do we get more users?

- How do we get more decentralized, secure, and fast? (move on the trilemma)

- How do we simplify the protocol (reduce technical debt across the board)

If we can optimize along these lines to the best of our ability, I don’t think we’ll ever look back with regret on the upgrades.

proposed improvements

In addition to simply going through the code with a fine tooth comb, simplifying it where possible, and submitting it for another audit, this is a list of planned changes to the Tellor protocol.

TellorFlex on mainnet

Currently TellorFlex is the structure name for Tellor on all chains that aren’t Ethereum. The main difference here is that the token is separated from the oracle contract. To both simplify Tellor’s system across chains and increase decentralization via modularity on mainnet, this change is entirely structural and TRB will maintain its current functionality.

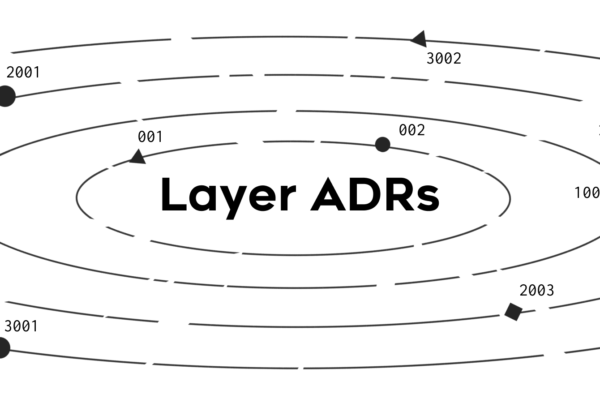

Remove any upgradeability (fully modular)

One current attack vector of Tellor is via the governance. The problem with governance attacks is that they can instantly affect the entire protocol. By removing upgradeability, any attack on governance will only affect a given queryID and not the system as a whole. The current minting via vote proposal or upgradeability of the contracts as a whole could be dangerous if attacked by a large enough holder. Simply removing the attack vector both simplifies the system and fits with our push towards an unbreakable protocol.

Redo governance (make similar to polygon governance)

A current issue with mainnet governance is that it’s solely based on token weights, with a small representation for users and reporters. The current governance model on other chains is 25% Reporters, 25% users (determined by tips made using the autopay smart contract), 25% team, and then 25% token holders. The team portion will eventually be handed over to a delegated group of community leaders, but for early chains it makes sense to build the support for that ecosystem. This change will both make the system more robust in terms of susceptibility to governance attacks and hopefully give more control to the actual participants/ stakers of the networks.

Stake Amount minimum is fixed in dollar terms

A risk with the current setup for users is that the price of the Tellor token will go down to zero and alongside its security. Tellor 360 requires the minimum staking amount to be either $1500 USD in TRB or 100 TRB tokens on Ethereum mainnet & $150 or 10TRB for Polygon. By using the oracle to fetch the price of the staking asset, we can assure users a guaranteed minimum level of safety when using the oracle. In addition, the variable amount will help to stabilize the Tellor price, leading reporters to buy more as the price falls and increasing security as the price rises.

Token is just a token

- Automated issuance

No more voting on issuance. We’re going to fix it at the current ~8,000 per month and leave it. This removes the governance risk inherent in being able to crank up the amount. The distribution will be 50% to the team (current rate) and 50% to time-based rewards on the mainnet oracle contract - No more treasuries

Since we will be fixing the minting rate and removing governance proposals, it makes the treasuries infeasible. - Allow the team to transfer TRB tokens accidentally sent to the token address

A small change requested by users, the the Tellor contract will have the ability for the team to transfer out tokens sent to the Tellor token address. This means no more losing tokens sent to the contract or oracle address! - 2% of the tips are given to staked reporters on each network

The autopay contract will have the same fee as it currently does (2 percent), but we will use the fee to reward staked reporters that vote on disputes on that network. For instance, if the Polygon autopay generates 10,000$ in fees over a month, that amount will be split amongst all staked participants on the Polygon network. This per-network fee system will encourage reporters to stake on networks where the generated fees are higher.

telliot changes

As for the main client of the Tellor network, the big question for us here is just how do we make it better. How do we monitor disputes better? How do we better handle API failures? How do we loop in MEV? How do we make sure that the network isn’t centralized (incentivize pools?)? These are all research questions that don’t necessarily have to be timed with the launch of Tellor360, but are rather pieces that we are continually working on. Tellor360’s flexible reward structure (vs timeBasedRewards) should herald in a whole new set of reporters doing requested queries across various networks. We’re excited for this piece as always and can’t wait to see the cool new features of the client and the network it creates.

messaging / branding changes

We can be honest, Tellor (and much of the crypto space) is in a bear market. We’re seeing the repercussions of it across our network and communications. Voting participation is down, new entrants are slower, and engagement has proven tough. But the bear market has its bright side; building is up (not just hype cycle marketing) and Tellor has more projects in our pipeline than ever before. Crypto projects are getting back to the principles of trying to create good, useful products without hyping massive raises or token sales. From our vantage point as a tool provider, it’s been exciting for us to watch, but this shift should guide us going forward.

We don’t need to focus on the flashy. Tellor is made for builders and it’s made to work in a simple and quick to integrate fashion. Tellor is a software, a network, and a protocol of crypto-economic incentives to secure the retrieval of off-chain data. This said, what you didn’t hear is community, DAO, chat room, brand, or meme factory. The changes for Tellor360 ensure that Tellor works for and by the people participating. There is a speculator class, but we want to continue to reduce reliance on the fickle hands of gamblers. Changes to our code will be reflected in our communication, but don’t worry, we’ll as always(the team, the unofficial team, and the various places where you all stand up for Tellor) remain as engaged as ever with anyone who wants to understand, use, or engage with Tellor.

takeaways

Tellor is evolving. The changes are more subtle than in years past, but we’re continuing to move towards a more secure and versatile system as the ecosystem changes. The proposed changes here are targeted to launch in late Q3/ early Q4 2022. We’d love your feedback, input, challenges, and thoughts as we continue to navigate the tumultuous space that is crypto.